Global Tonic Water Market Size And Forecast By Product (Regular and Diet) By Distribution Channel (Supermarket and Hypermarket, Convenience Stores, and Online Retailers) And Trend Analysis, 2019 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Consumer Goods

Industry Insights

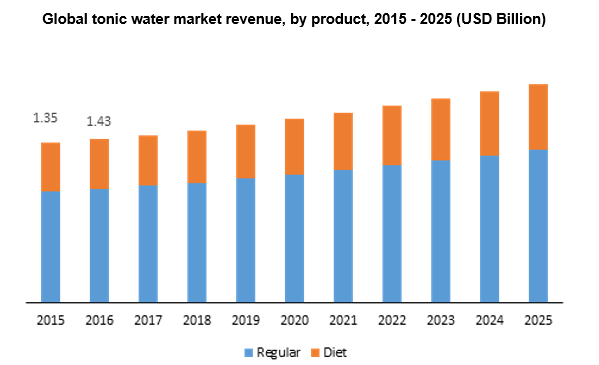

The global tonic water market was estimated at USD 1.51 billion in 2017 and is expected to grow at a CAGR of 6.3% from 2017 to 2025. Factors such as increasing urban population associated with rising disposable income and modernized lifestyles are impacting the growth of the global market.

The rising population of millennials and their changing lifestyles are resulting in an increasing number of clubs and lounges which are expected to boost the demand for such mixes. Consistent development of tonic mixes induced with various flavors to drive in consumers is also anticipated to enhance the sales of these products.

Tonic water is primarily used as a mixer ingredient for various alcoholic drinks such as gin, vodka and others. Rising awareness along with growing popularity of cocktails is contributing to the increasing demand for tonic water. Moreover, trending party culture among the younger population is driving the demand for various alcoholic drinks. Therefore rising consumption of these beverages is expected to drive the application of mixes thereby boosting up the global sales.

Per capita alcohol consumption is significantly higher in the developed countries such as the U.S., UK, France, and Germany. For instance in 2014, the per capita alcohol consumption in Germany accounted for about 9.6 liters and 7 liters in the U.S. As of 2017, Spain accounted for the highest consumption of gin of about 1.07 liters per person mainly due to status quo, artistic culture, and presence of a large number of retail outlets dealing exclusively with such products. These factors are anticipated to drive the global tonic water industry.

Segmentation by Product

• Regular

• Diet

Traditional or regular mix segment holds a significant share accounting for more than 50% in the global industry. This market scenario is attributed to the increasing consumption of alcoholic drinks in high-income countries. According to USDA ERS (United States Department of Agriculture - Economic Research Service), it was estimated that U.S. restaurants and bars witnessed the maximum consumer spending on alcohol until 2017. This factor had contributed to the consumption of various alcoholic beverages and tonic water as a mixing product.

Diet tonic water is gaining increasing acceptance among the consumers owing to its lesser sugar content. As compared to regular, diet variants possess fewer calories or carbohydrates. The sugar content is substituted by the addition of sweeteners which are approved by the U.S. Food and Drug Administration (FDA). Companies are also bringing in new naturally flavored water in this product segment, with an aim to cater to the consumers’ specific needs for diet consciousness and taste factors. For instance, Sodastream offers naturally flavored diet tonics with zero calories.

Segmentation by Distribution Channel

• Supermarket and hypermarket

• Convenience Stores

• Online Retailers

Supermarket and hypermarket held the majority of the revenue share of more than 50% in the global tonic water market. This scenario is attributed to the easy availability and visibility of the products. However, with the introduction of new players, an increasing number of internet users, ease of access, fast-paced lifestyle, 24/7 availability, convenience and several options to choose from are some of the factors expected to drive sales of these products through online medium. Companies are actively distributing their products through online channels either through their own portals or third-party retailing with an aim to widen their consumer base.

Segmentation by Region

• North America

• U.S.

• Canada

• Europe

• Spain

• UK

• Asia Pacific

• India

• Central and South America

• Middle East and Africa

North America accounted for more than 30% of the revenue share in the global tonic water market. North America is the second largest supplier of this product having a production share of about 30% in 2017. The popularity and surging demand for gin is expected to boost the acceptance of tonic mix in the next few years

The mixing of tonic water in alcoholic beverages is prominent in developed countries. The market is still at its nascent stage in the developing economies due to less awareness about the product and also a relatively lower preference of gin. As compare to North America and Europe, the Asian countries having a high consumption of gin such as the Philippines, do not use alcoholic mixers frequently.

Competitive landscape

Key players operating in the global market include Fever Tree, Dr Pepper Snapple Group, SodaStream International Ltd., Whole Foods, White Rock, Fentimans, East Imperial, Lamb & Watt, Luscombe, Q Tonic LLC to name a few. The companies are increasingly focusing on introducing new products induced with various flavors and less sugar content to serve the varied needs of the consumers.

In 2016, the gin sales in the UK’s through on and off-trade exceeded more than USD 1 billion which marked the rise in the sales of tonic mixes. In December 2017, UK witnessed an increase in the alcohol sales through supermarkets attributed mainly to the consumers purchasing more expensive festive alcohols wherein gin sales shot up by 26%, and the demand for whiskey went up by 10%. Premium brands, such as Fever-Tree, are also preferring to introduce and display more premium products during the festive seasons.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service