Type 1 Diabetes (T1D) Market Size and Forecast, By Insulin Analog (rapid Acting, long Acting, Premix Analogs), And Trend Analysis, 2014 - 2024

- Published: October, 2017

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Pharmaceuticals

Industry Insights

The global type 1 diabetes market size was valued at USD 25.52 billion in 2016 and is expected to exhibit rewarding growth over the forecast period. This is majorly due to the significant increase in type 1 diabetes (T1D) prevalence followed by rising uptake of novel formulations of insulin analogs and auxiliary therapies. As per International Diabetes Federation (IDF), in 2015 around 542,000 children aged under 14 years were affected by T1D worldwide and is expected to increase in the future thereby increasing the uptake of insulin analogs.

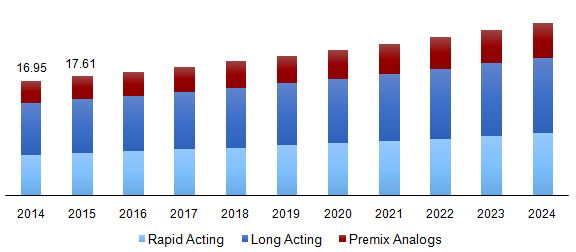

Global type 1 diabetes market revenue, by insulin analog, 2014 - 2024 (USD Million)

Type 1 diabetes is a multifactorial, chronic and autoimmune disorder characterized by the progressive destruction of the pancreas resulting in loss of insulin secretion and production. Though this type of diabetes is rare, still it is witnessing a 3% increase every year especially among children. Type 1 diabetes treatment is facilitated by the administration of various types of insulin analogs. These products when administered, mimic the body’s natural pattern of insulin hormone release. There are three kinds of insulin analogs employed namely rapid-acting, long-acting and premix analogs. Also, currently a lot of regenerative therapies focusing on pancreatic islet transplantation and cell substitution are in developmental stages. These promising treatments further enhance the overall growth of diabetes treatment market.

The global type 1 diabetes market is anticipated to gain momentum during the forecast period owing to the necessary use of insulin to treat this disorder in conjunction with the increasing obesity rates, sedentary lifestyle and improper food habits. On the other hand, this disease poses a substantial economic impact on several countries and their national healthcare systems. It places a significant financial burden owing to the cost of the insulin and other related complications such as cardiac problems, kidney disorders, and ophthalmic disorders. For instance, diabetes expenditure ranges from 5% to 20% of the respective countries total healthcare spending.

Segmentation by Insulin Analog

• Rapid acting insulin analogs

• Long acting insulin analogs

• Premix insulin analogs

The long acting insulin analogs market generated a revenue of USD 8.23 billion in 2016. These insulins are the most widely used type owing to the low-cost increasing use in several insulin infusion devices. Aspart, Glulisine, and Lyspro account for the major rapid-acting insulins available. Hence, quick mode of action followed by increasing uptake of the novel formulations will strongly support the market growth.

Premix analogs segment is expected to record the highest growth rate as it possesses the properties of both rapid and long-acting insulins. These insulins possess a ratio of long-acting and rapid-acting insulins, for instance, Humalog Mix The uptake and acceptance of insulin therapy will increase over the forecast period as the patients suffering from this disorder needs to be on lifelong insulin therapy.

Also, high probability of the launch of new and improved insulins and rigorous research and development activities will further support the global T1D market growth. For instance, the recent launch of Tresiba and Xultophy by Novo Nordisk renders a strong growth in the coming years for the company.

Segmentation by Region

• North America

• U.S.

• Europe

• UK

• Asia Pacific

• China

• India

• Rest of the World (RoW)

North America accounted for more than 50% of the total market share owing to the increasing prevalence of this disorder followed by high prices of insulin and the enhanced uptake of novel formulations of insulin. According to the statistics provided by International Diabetes Federation (IDF), in the year 2015, United States accounted for the topmost country with the highest number (84,100) of children (below 14 years) who have type 1 diabetes as compared to other countries. India held the second spot with 70,200 children suffering from this condition. Asia Pacific region recorded the highest growth rate over the forecast period owing to the increasingly sedentary lifestyles, obese population, and unhealthy diet habits.

Competitive Landscape

The global type 1 diabetes market is highly consolidated in nature with three companies Novo Nordisk, Eli Lilly and Sanofi dominating the sector with their extensive product portfolio and a strong pipeline. However, several new entrants with their biosimilar portfolio are anticipated to mask the market share of the former companies.

Hence, the established players are implementing several strategies to protect their franchises from the biosimilar erosion. For instance, Sanofi recently launched a superior biosimilar version of Lantus. This product is marketed by the name Toujeo. Additionally, the major stakeholders in the T1D market include Takeda Pharmaceutical Company Ltd., Bayer Pharmaceuticals C.H. Boehringer Sohn AG & Co. KG, among others.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service