U.K. Natural Food Colors Market Size and Forecast By product (Carotenoids, Curcumin, Anthocyanin, Carmine, Copper Chlorophyllin), By application, And Trend Analysis, 2014 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 72

- Industry: Food Additives & Nutricosmetics

Industry Insights

The U.K. natural food colors market size was valued at USD 49.4 million in 2016 and is estimated to grow further over the forecast period. Demand growth from application industries, such as beverages and bakery and confectionery, will add to the expected growth of the market.

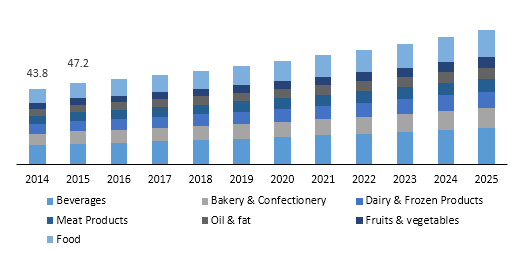

U.K. natural food colors market size, by application, 2014 - 2025 (USD Million)

Increasing health consciousness is also projected to spur the product demand. Thus, manufacturers are inclined more towards the production of such colors. The market also receives added impetus from the regulatory framework, which does not support the use of synthetic colors.

Natural food colors are extracted from natural sources, such as berries, turmeric, fruits and vegetables. As a result, the nutritional value of the final products is high. These colors are good sources of anti-oxidants, vitamins, and other important nutrients. Growing beverages industry in U.K. is expected to have a significant impact on the product demand, thereby boosting the regional market growth. Furthermore, health hazards associated with synthetic food colorants, such as kidney tumors and several types of allergies, are expected to restrain their demand, which in turn will augment U.K. natural food colors market.

The European Union, along with a few other associations, have imposed regulations on the application and permissible amount of synthetic food colorants in consumables, as they trigger hyperactivity and behavioral problems in children. This will drive the market growth in U.K. In line with the change in consumer preference and prevailing regulations, manufacturers are shifting their focus towards natural food extracts over synthetic food colors.

This will also strengthen the market growth over the forecast period. The manufacturing process of natural food colors is relatively expensive as the production processes need state-of-the-art technologies and machinery, which are costly. In addition, the sources from which these colors are extracted have multiple applications owing to which the price of the natural food colors is high.

Segmentation by Product

• Carotenoids

• Curcumin

• Anthocyanin

• Carmine

• Copper Chlorophyllin

• Others

Carotenoids accounted for majority of the market share. It is preferred as an anti-oxidant and is also effective against chronic diseases. Carotenoids are also used in non-alcoholic beverages, bakery, and frozen products, which adds to its growth prospects. On the other hand, anthocyanin is a preferred product mainly in the food and beverage industry as it offers appropriate pH stability in most applications and withstands Ultra-Heat Treatment (UHT) and pasteurization.

Anthocyanins are also among the few sources of natural blue and purple shades that are stable, water soluble, and insoluble colors. These properties tend to increase their applicability in various products and thus keep the demand buoyant. Some other natural food colors include betalains, anthraquinones, betanin, annatto, lycopene. Betalain is derived from beetroots, which is considered as a pure source of several nutrients that are essential for overall growth.

Segmentation by Application

• Bakery and Confectionery

• Beverages

• Dairy and Frozen Products

• Meat Products

• Oil and Fat

• Fruits and Vegetables

• Food

The U.K. natural food colors market is expected to grow on account of increasing demand from several application industries. Rising consumer demand, along with favorable government policies, is expected to drive the market in U.K. The beverages segment is expected to account for the largest market share over the forecast period.

This can be attributed to the increasing usage of natural food colorants in natural fruit juices and soft and health drinks. Red, yellow, and orange are among the widely used colors in beverages owing to their vibrant shades. As a result, demand for carotenoids, carmine, and curcumin is expected to grow considerably during the forecast period. Product penetration is high in U.K.

Food and beverage segment is among one of the largest industrial sectors in U.K., which generates considerable demand for natural products. The food segment comprises consumables, such as soups, salads, condiments, dressing, oils, and sauces.

Competitive Landscape

The U.K. natural food colors market is competitive and is marked by the presence of multiple companies, such as Naturex U.K. Ltd., Roha U.K. Ltd., Chr. Hansen U.K. Ltd., Sensient Technologies Ltd., Döhler, and Diana Group and ADM Company. These international companies have manufacturing facilities and sales offices spread across the globe.

Naturex is exclusively into the manufacturing of products including natural ingredients, dietary supplements, and natural colorants and flavors. Most of these companies focus on R&D activities to develop products with enhanced properties, such as pH and heat stability.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service