U.S. Electric Vehicle (EV) Charging Infrastructure Market Analysis, By Type (Slow Chargers, and Fast Chargers), By Connector (CHAdeMO, Combined Charging System (CCS)), By Application, And Segment Forecasts, 2014 - 2025

- Published: July, 2018

- Format: Electronic (PDF)

- Number of pages: 52

- Industry: Automotive & Transportation

Industry Insights

The U.S. electric vehicle charging infrastructure market was valued at USD 167.6 million in 2017 and is predicted to grow further over the forecast period. The increasing adoption of electric vehicles is expected to propel the growth of supporting charging infrastructure. In the United States, governments and the insurance companies provide lucrative offers to promote the selling and usage of EVs. Tax benefits are provided at the time of purchase. However, the extent of exemption depends on the size of batteries used in the vehicle. Countries like France and the UK offered bonus payments to EV buyers and discounts on insurance.

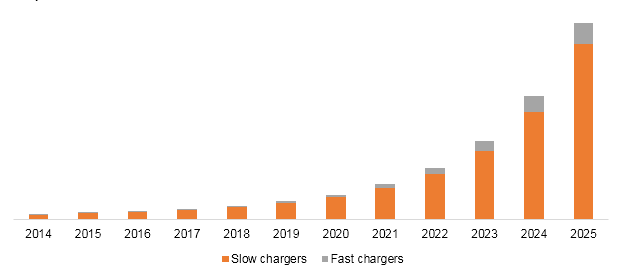

U.S. electric vehicle charging infrastructure market, by charger type, 2014 - 2025 (thousand units)

One of the key challenges in setting up EV infrastructure is the high cost. This cost includes the commercials involved in charging equipment installation & maintenance and operational costs. Unanticipated costs may incur, in the case of faulty or damaged charging equipment. The adoption of EVs depends on the number of charging stations available throughout a city. A low number of charging stations is expected to hinder the adoption of EVs.

To promote the adoption of electric vehicles, efforts toward increasing supporting infrastructure would be higher in commercial spaces, as overnight charging at residential complexes or home would not be sufficient. Moreover, public charging infrastructure facilitates long distance traveling, and help reduce range anxiety.

Segmentation by charger type

• Slow Chargers

• Fast Chargers

The U.S. electric vehicle charging infrastructure market is segmented into slow charger and fast charger. The fast charger segment is expected to grow at a fast pace over the forecast period. The fast charger segment consists of DC Ch argers and Rapid AC chargers. The fast charger segment is anticipated to be the key segment over the forecast period, owing to the growing adoption of electric vehicles and ambitious targets set by various countries. The slow chargers segment is anticipated to grow at a high rate. The slow charger consists of public slow charger and private slow charger.

Segmentation by connector

• CHAdeMO

• Combined Charging System (CCS)

• Others

The CHAdeMO connector segment is anticipated to emerge as the fastest-growing segment. The CHAdeMO segment was valued at around USD 40.0 million in 2017 and is is anticipated to grow further over the coming years. The CCS segment, on the other hand, is another lucrative segment after CHAdeMO connector. A CCS connector is developed by combining the basic SAE J1772 and two additional large pins for quick charging. It supports both slow and fast charging. Further, it utilizes a PLC protocol that is a part of smart grid protocols.

Segmentation by application

• Commercial

• Residential

In terms of application, the commercial segment is anticipated to grow over the next eight years. The residential application segment is expected to grow considerably compared to its commercial counterpart by 2025. Overnight charging at homes or residential complexes is the preferred way of charging, owing to their ease and convenience. However, these places have lesser DC quick charger, as they are costlier than AC chargers.

Competitive landscape

U.S. EV charging infrastructure market has numerous players, such as ChargePoint, Inc., AeroVironment Inc. General Electric Company, Leviton Manufacturing Co., Inc., SemaConnect, Inc., Tesla Motors, Inc., ClipperCreek, Inc. Amongst all ChargePoint, Inc. is the leading company as it provides electric vehicles with a charging solution for various businesses, such as commercial real estates, parking operators, offices, and hospitality.

The major key strategies include collaborations, related segment revenues, new product developments, expansion capabilities, merger & acquisitions, partnerships & agreements, and research & development investments, among others. It is also done based on product offerings and a number of application segments served by a company.

AeroVironment Inc. has a dominant presence across the U.S. that comes from its sales revenue of which 72% comes from the U.S. clients. Many other companies are engaged in building network and data connectivity solutions, electrical wiring devices, and lighting energy management system for residential, commercial, and industrial buildings. It also manufactures switches, receptacles, daylight harvesting controls, and equipment for charging electric vehicles.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service