U.S. Medical Gases Market Size and Forecast, By Product (Pure Gases, Gas Mixtures, Gas Equipment), By Application (Therapeutic, Diagnostic), And Trend Analysis, 2013 - 2024

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 98

- Industry: Healthcare

Industry Insights

U.S. medical gases market size was valued at USD 2,756.8 million in 2016. Increasing use of these gases for the treatment of Cardiovascular Diseases (CVDs) and respiratory illnesses is expected to drive the market over the forecast period. Medical gases and equipment have broad range of application in various industries including pharmaceutical, and biotechnology.

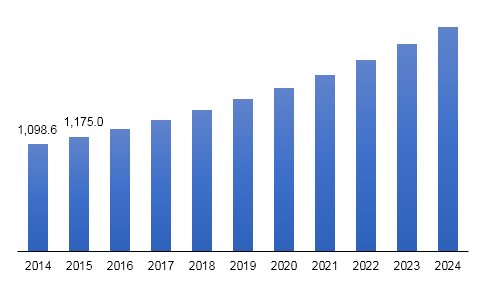

U.S. medical gases market therapeutic application, 2014 - 2024 (USD Million)

Increasing consumption of tobacco and alcohol along with sedentary lifestyle and lack of physical activities resulting in obesity, BP issues and other health problems would also augment the market development. In addition, increasing cases of diabetes and hypertension will boost the market demand over the projected period. According to the World Health Organization, chronic diseases, such as cancer, stroke, and Chronic Respiratory Diseases (CRDs), were accountable for more than 30 million deaths in 2012.

According to Centers for Disease Control and Prevention, in 2010, the total amount spent for the diagnosis/treatment of stroke and heart diseases in U.S. was around USD 315.4 billion. Implementation of Current Good Manufacturing Practice (CGMP) by the U.S. Food and Drug Administration (FDA) has made manufacturers to ensure safety precautions while product packing, transporting.

Implementation of these initiatives is expected to add to the growth of this industry over the projected period. Growing geriatric population base in U.S. is also expected to support the industry growth. Furthermore, demand for Point-of-Care (PoC) diagnostics and home healthcare will bode well for the U.S. medical gases market.

Segmentation by Product

• Medical pure gases

• Medical gas mixtures

• Medical gas equipment

In terms of revenue, medical gas equipment segment led the market in 2016. Increasing demand for PoC diagnostics and home healthcare is expected to drive the segment further. Growing need for humidity treatment and respiratory therapy is also expected to spur the market expansion. It involves helium, carbon dioxide, oxygen, nitrous oxide, and nitrogen. Extensive usage of pure gases in ensuring oxygen availability in cyanosis, COPD, and shock, to return tissue oxygen tension is expected to propel the segment growth.

Advances in therapeutic uses of oxygen coupled with its usage in treating hypoxia and hypoxaemia are projected to drive the market further over the forecast years. In addition, strict guidelines and regulations pertaining to the manufacturing, handling, controlling, and usage of oxygen are projected to have a positive impact on the segment expansion.

Segmentation by Application

• Therapeutic

• Diagnostic

• Others

In terms of revenue, the therapeutic segment led the U.S. medical gases market in 2016. Increasing number of patients suffering from CRDs, stroke, heart disorder, cancer, and diabetes, is expected to drive the segment. Furthermore, growing geriatric population base in U.S is estimated to contribute toward the market development. Therapeutic medical gases are pharmaceutical molecules that provide solutions to medical requirements.

Diagnostic application segment accounted for around one-third of the overall market share in 2016. Apart from therapeutic applications, they are largely used to maintain and check accuracy and reliability of medical devices and diagnostic equipment. Other application areas include biotechnology, pharmaceutical manufacturing, drug discovery and development, process development, and cryotherapy.

Competitive Landscape

Many major companies in the market are adopting mergers & acquisition and product development strategies to expand their business. For instance, Air Liquide acquired Airgas, Inc. in 2016. Some of the leading companies operating in the U.S. medical gases market include Airgas, Inc.; Air Products and Chemicals, Inc.; BeaconMedaes LLC; Air Liquide S.A.; The Linde Group; Medical Gas Solutions Ltd.; Matheson Tri-Gas, Inc.; and Praxair, Inc.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service