U.S. Online Grocery Retail Market Size And Forecast, By Type (Food Products, Non-Food Products) And Trend Analysis, 2015 - 2025

- Published: July, 2018

- Format: Electronic (PDF)

- Number of pages: 46

- Industry: Food & Beverages

Industry Insights

The U.S. online grocery retail market size accounted for USD 13.89 billion in 2017. Grocery e-commerce in U.S. holds high potential, especially with rapid technological advancements and high acceptance of new technologies and concepts among the populace. Increasing number of retailers and advantage of real-time comparison between offerings from various retailers are also expected to stimulate the growth of the market. For instance, in 2015, around 31.0% of U.S. grocery shoppers purchased grocery online.

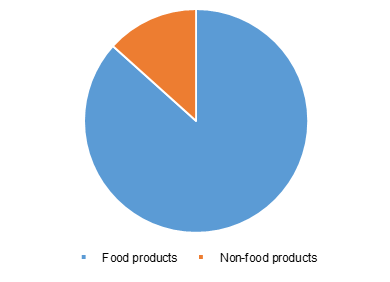

U.S. online grocery retail market revenue split, by type, 2017 (% share)

Certain section of the consumer base in the country is inclined towards buying only specific items through the distribution channel and on an occasional basis. Thus, a large part of the market is still untapped as consumers still prefer traditional brick-and-mortar stores for big basket shopping.

Many customers prefer online shopping owing to various loyalty programs and home delivery options provided by e-tailers. Furthermore, millennials contribute to the evolution of online spending trends. They comprise one third of the overall population and are the largest spenders on grocery shopping. This tech savvy and highly connected group is expected to contribute to the growth of digital grocery shopping in near future.

Busy lifestyle of millennials is driving the need for hassle-free shopping experience. This generation of digitally engaged shoppers is continuously seeking for better quality at lower prices and are attracted to online discounts and coupons from different retailers. Thus, online retail benefits and convenience offered by retailers is expected to lure the young generation and aid in increased sales through this distribution channel.

There are numerous players in the U.S. online grocery retailing market, such as Amazon, Kroger, Walmart, and Peapod. Moreover, many startups are entering the market such as Farmigo, Shipt, Instacart, FreshDirect, and Safeway. Additional services provided by online retailers, such as pick up, online app, same day delivery, and concierge shopping, have lured consumers and is driving the market. Amazon is the market leader with its subsidiary AmazonFresh and addition of its house brands such as Whole Foods.

Popular grocery items from Amazon are beverages, coffee, snack food, and breakfast food. Moreover, acquisition of Whole Foods, Inc. and a renowned brand in fruit, vegetable, and meat has helped expansion of its consumer base. Moreover, special marketing strategies such as prime pantry, which offers various household basics such as packaged food and weekly deals, has gained popularity over the past few years. Thus, grocery business in the country is anticipated to evolve significantly over the forecast period.

Segmentation by type

• Food Products

• Non-food Products

Food products are anticipated to account for the leading share in the U.S. online grocery retailing industry throughout the forecast period. This can be attributed to various food products available on the e-commerce platform. From beverages such as juice, tea, and coffee, to food items such as bakery items, snacks, fresh and dried fruits, spices and condiments, canned and jarred foods, cereals, ready-to-eat and cooked food, and meat and seafood – easy availability of different foods from various brands on a single website is estimated to drive the segment. Moreover, online retailers offering fresh food products and house brands offering organic food are gaining popularity. Thus, fruits and fresh produce are finding place in product portfolio of e-tailers, which in turn is estimated to work in favor of the U.S. online grocery retail market. For instance, AmazonFresh offers fresh vegetables and fruits as well as canned and dried organic foods. This is expected to lure customers.

Non-food items such as kitchen essentials and basic products for everyday use are also available on e-commerce platforms. Retailers are focusing on enhanced product offerings, which consist of items such as paper towels, air fresheners, household cleaning items, dish washing products, and trash bags, of different brands from various vendors and of varying quantity and price. Thus, easy availability of numerous products is driving the market.

Moreover, local products such as meat, prepared meals, and dairy products are attracting customers. Changing consumer lifestyles and hectic daily routines are leading to popularity of home delivery feature, which provides hassle-free shopping experience to busy customers and are likely to augment the U.S. market in future.

Competitive Landscape

The online grocery retailing market has numerous well-established players in the country. Some of the prominent companies operating in the market are Walmart, Amazon, and Kroger. Several brick-and-mortar grocery channels are gradually venturing into e-commerce platform. Amazon is the leading player in the U.S. market. Players such as Walmart and Kroger are also undertaking digital transformation. For instance, Walmart launched its e-grocery as store pick-up rather than a home-delivery service platform. Other players offer personal shopper services to customers to enhance their visibility in the market.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service