U.S. Online Residential Furniture Market Size and Forecast, by Use (Living room, Bedroom, Dining & Kitchen) by Material (Wood, Metal, Leather), and Trend Analysis, 2014 - 2024

- Published: September, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Consumer Goods

Industry Insights

The U.S. online residential furniture market size was valued at USD 16.5 billion in 2016 and is expected to grow over the forecast period. Growth in the market is attributed to the stability in real estate industry at large and strengthening of consumer confidence. Home sales in the U.S. have moved northwards, and with the favorable macroeconomic environment, users have started investing in associated home essentials including furniture.

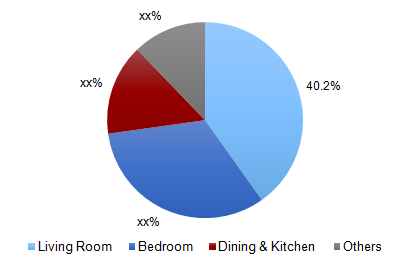

U.S. online residential furniture market share, by use, 2016 (%)

Among the various consumer groups, millennials lead the pack in the online residential furniture market. Millennials are well-versed with digital devices and are aware of various online platforms, which coupled with their propensity to explore and compare furnishings online, places them as one of the key consumer groups in the market. In addition, millennials portray their active presence on social networking platforms and are compatible with online purchases, which makes them even more receptive of the online residential furniture industry. Among the digital platforms, furniture shopping using handheld devices such as smartphones continue to dominate the market, as it facilitates buying on-the-go. In addition, online furniture vendors’ move to enhance consumer shopping experience by empowering them to visualize units before purchasing using augmented reality applications has also added to the growth of the market.

Personalised reward programs from online furniture vendors, such as Wayfair, is yet another initiative which has ensured loyalty among shoppers and in many cases, has translated into repeat shopping. While the market is expected to grow over the forecast period, at large it faces certain operational challenges, mainly pertaining to logistics.

Operational challenges, primarily related to order fulfillment continues to be a key aspect which tends to affect their top line. To that end, unexpected delay, damaged product delivery, and an increase in service charges by order fulfillment companies remain critical challenges. For instance, in 2016, companies such as UPS and FedEx increased their handling fee for bulky products to suffice for the space bulky products take in delivery vehicles.

Segmentation by Use

• Living room

• Bedroom

• Dining & kitchen

• Others

Living room segment dominated online residential furniture industry in 2016. The segment commanded a major share of the market in 2016 and is expected to continue to dominate over the forecast period. Among the various furniture in the living room, sofa remains the key product category consumers spend mainly on.

With the prevailing correction in the U.S. housing sector and stable macroeconomic factors, the market is expected to remain stable over the forecast period, with consumers leveraging the benefits of product comparison, shopping on-the-go and from the confort of their homes.

Segmentation by Material

• Wood

• Metal

• Leather

• Others

In 2016, wood furniture commanded a major share of the market. Consumers prefer wood fixtures because it optimises investment by enhancing the aesthetics of the living room, is durable, easy to maintain, and can be refinished to give it a fresh look towards the end of its active life. In addition, wood units are highly customisable and offer a wide assortment of design and wood varieties such as softwood (Pine, Cedar) and hardwood (Walnut, Maple, Oak). The segment is expected to continue to dominate over the forecast period, as consumers are expected to spend on the trade-off between wood and other furniture over the forecast period.

Competitive Landscape

The U.S. online furniture retailing market is competitive with the presence of well-established vendors such as Wayfair and Walmart. The active vendors in this space face competition from online as well as brick and mortar furniture retailers having an online presence.

The prevalence of omnichannel retailing is expected to gain strength over the coming years and is projected to spur existing brick and mortar players to mark their presence online. In light of the stabilizing economic factors and the residential housing market at large, active players are expected to focus on increasing their existing SKUs and enhance consumer shopping experience.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service