U.S. Polyolefin Market Size And Forecast, By Product (Polyethylene, Polypropylene, Ethylene Vinyl Acetate, Thermoplastic Olefin), By Application, And Segment Forecast, 2014 - 2025

- Published: September, 2018

- Format: Electronic (PDF)

- Number of pages: 56

- Industry: Specialty & Fine Chemicals

Industry Insights

The U.S. polyolefin market accounted for USD 51.9 million in 2017 and is expected to grow further over the forecast period. The market in U.S. is expected to grow due to high demand lightweight and durable products from automotive, electronics, film and sheet, and construction industries. Major plastic manufacturers across the globe are investing in R&D to meet the increasing demand for innovative plastic products from end-user industries.

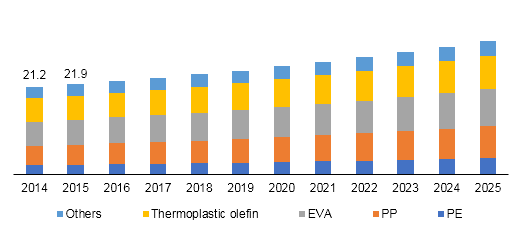

U.S. polyolefin market volume, by product, 2014 - 2025 (Million Tons)

They are also are focusing on developing quality products, in terms of chemical and physical properties. Thus, rising product innovations to develop technologically advanced end-products, particularly in the automotive sector, with reduced carbon emissions will boost the market. Rising scope of application in areas, such as general assembly and filtration, will also augment the market development.

New polyolefin end-products are being used to produce efficient substitutes for heavy, hard-to-recycle, and expensive materials used in automotive industry. Diverse applications in different industries, such as sporting goods, consumer products, furniture, houseware, appliances, and automotive, are expected to propel product demand. Stringent safety standards in the U.S. automotive industry has initiated product development in areas, such as seat belts, straps, cushioning material, and seating.

Rapidly expanding end-use industries, such as construction, packaging, electrical and electronics, and automotive, in the region will also spur the U.S. polyolefin market demand. Demand from e-commerce and logistics industries for product packaging applications has also supported the market growth. Moreover, demadnfrom different sectors of consumable goods will also support the growth.

Segmentation by Product

• Polyethylene

• Polypropylene (PP)

• Ethylene Vinyl Acetate (EVA)

• Thermoplastic Olefin

Polyethylene and PP and are the most widely produced polyolefins. Polyethylene has a crystalline structure, which increases its chemical and mechanical stability leading to wide usage in film and sheets, electrical insulation, and construction sectors. It is also used as a prototype for CNC machines and 3D printers. Ease of manufacturing and wide applications of PP contribute to its rising demandfor. Ethylene vinyl acetate is transparent, which makes it appropriate for usage in packaging and processing industries.

Segmentation by Application

• Film and Sheet

• Injection Molding

• Blow Molding

• Profile Extrusion

Film and sheet segment is expected to grow at the fastest CAGR over the forecast period. On the other hand, injection molding is the largest revenue contributor in the U.S. polyolefin market. It is used in a wide range of applications across various industries. However, injection molding is expected to witness competition from thermoforming. LDPE, LLDPE, HDPE, EVA, PP, and TPO are the polyolefins that are processed through injection and blow molding.

Competitive Landscape

The U.S. polyolefin market is marked by the presence of a few well-established firms commanding major share, making the market concentrated in nature. Some of the key companies in the market include Sinopec Corporation, LyondellBasell Industries Holdings N.V, Petrochina Company Limited, ExxonMobil Corporation, The Dow Chemical Company, Total SA, Chevron Corporation, Repsol, Braskem, and Borealis AG.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service