U.S. Specialty Household Cleaners Market Size and Forecast, By Product (Hard Surface Cleaners, Glass Cleaners, Toilet Bowl Cleaners, Metal Polishes), By Application (Bathroom, Kitchen) And Trend Analysis, 2014 - 2024

- Published: September, 2017

- Format: Electronic (PDF)

- Number of pages: 40

- Industry: Bulk Chemicals

Industry Insights

The U.S. specialty household cleaners market size was valued at USD 5.79 Billion in 2016 and anticipated to grow at a CAGR of 4.1% over the forecast period. Increasing awareness about hygiene among consumers and industries in the U.S. is expected to boost the market. Furthermore, the overall need for clean and hygienic surrounding is projected to increase the market during the forecast period.

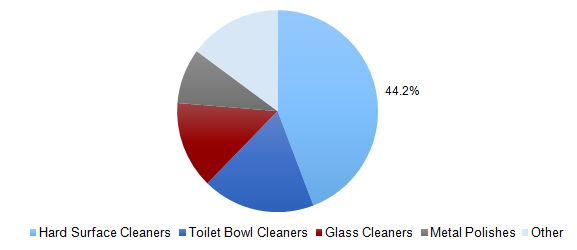

U.S. Specialty Household Cleaners market revenue, by material, 2016 (%)

Consistent technological innovation, coupled with rigorous implementation of advertising, and marketing strategies by the companies to sustain the increasing competition is anticipated to increase the demand for these products over the forecast period. Also, several initiatives introduced by the U.S. government will support the growth of the market in the near future. For instance, The American Cleaning Institutes in the United States initiated creating awareness amongst the public, regarding the benefits of disinfecting and sanitizing products.

Specialty household detergents are designed for glass surface, bathroom surfaces, drains, metal, floors, carpets, furniture, and soils that are accumulated on the surfaces. These products aid in maintaining hygiene and cleanliness thereby preventing the occurrence of various disorders.

Hazardous effects of these specialty household cleaners coupled with adverse environmental effects can pose serious health issues such as acute respiratory irritation or chronic conditions such as cancer, thereby negatively impacting the growth. However, the increasing introduction of eco-friendly and chemical free specialty cleaners are expected to boost the acceptance.

Segmentation by Product

• Hard Surface Cleaners

• Glass Cleaners

• Toilet Bowl Cleaners

• Metal Polishes

• Other

In 2016, hard surface cleaners accounted for 44.2% of overall market share and is anticipated to exhibit the fastest growth over the forecast period. Specialty household surfactants are employed for floor care in bathroom and kitchen application. Floor cleaners render gleaming and germ-free floors, eliminate dust, and maintain the environmental hygiene. On the other hand, usage of inappropriate quantities of these chemicals can result in the slip and trip accidents, resulting in severe physical injuries. This factor may hamper the market growth.

Toilet bowl cleaners segment is anticipated to grow at a CAGR of 4.3% over the forecast period. Products such as surfactants and fresheners are intended to maintain a clean and pleasant smell in the toilet bowl. However, deviation in following the instructions about the use of these products can result in health concerns and even impact their acceptance.

Segmentation by Application

• Bathroom

• Kitchen

• Other

Bathroom application accounted for 45.2% of the market share in 2016 and are expected to continue their dominance over the projected period on account of increased awareness regarding health and hygiene. Proper hygiene and sanitary conditions form an essential part of the U.S. consumer lifestyles, which is expected to have a positive impact on the demand for cleaning products.

Increasing awareness regarding health & hygiene is anticipated to boost the market for kitchen cleaners. Regular cleaning and sanitizing the kitchen can prevent the spread of germs and ensure good health. Hence, the extensive use of kitchen cleaning products to ensure contamination-free surfaces will enhance the acceptance of these products during the forecast period.

Competitive Landscape

This market in the U.S. is consolidated in nature with the presence of few companies operating in multiple regions. The market witnesses the presence of well-established companies such as Clorox Co., Reckitt & Benckiser, Procter & Gamble, S.C. Johnson & Son, Inc., Church & Dwight Co., Inc., Henkel KgaA, Kao Corporation, Unilever, and Colgate Palmolive Co. Companies are adopting mergers and acquisitions strategies to expand their presence in global market. For instance, in January 2017, Prestige Brands Holdings, Inc. acquired C.B. Fleet company to extend its product portfolio.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service