U.S. Wood Plastic Composite Market Size And Forecast, By Product (Polyethylene, Polyvinylchloride, Polypropylene), By Application (Building & Construction, Automotive, Industrial & Consumer Goods), And Trend Analysis, 2014 - 2025

- Published: July, 2018

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Advanced Materials

Industry Insights

The U.S. wood plastic composite market size was valued at USD 1.90 billion in 2017. The market is primarily driven by growing demand from construction industry owing to rapid infrastructure development in U.S. Furthermore, demand from automotive industry is projected to fuel demand. Supportive regulations involving federal subsidies and various state incentives are expected to augment regional market expansion over the forecast period. Investment plans proposed by the government, low interest rates, and increased disposable income is projected to promote demand for wood plastic composite (WPC) from construction sector.

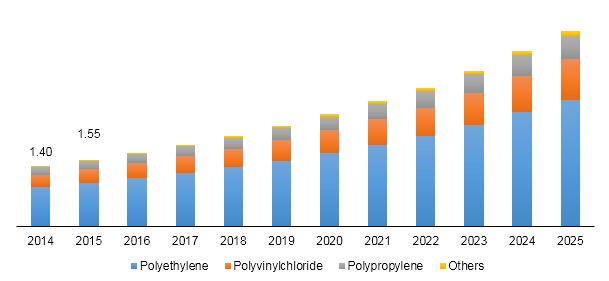

U.S. wood plastic composite market, by product, 2014 - 2025 (USD Billion)

Rising demand for lightweight vehicles to boost fuel efficiency and to reduce carbon emissions is expected to propel growth. Adoption of hollow technology to manufacture lighter, tougher, and fast-responsive wood plastic boards helps enlarging cross-section and increasing load-bearing capacity. Furthermore, rising applications in household electronics such as vacuum cleaners and irons is expected to open new business avenues over the coming years.

Adoption of latest technology is anticipated to assist in reducing weight of wood plastic composite products and to enhance their mechanical properties for structural use. Foam technology serves the purpose of weight reduction by using physical or chemical blowing agents that create cavities inside polymers. WPC manufactured using foaming technology find application in residential projects. Rising adoption of advanced technologies has enabled utilization of variable composition of thermoplastic and wood materials. This factor is anticipated to bode well for market growth over the forecast period.

On account of non-renewable nature of plastic, U.S. is giving prominence to utilization of wood plastic composite in automotive production. These products entail lower greenhouse emissions. This factor is expected to create consumer awareness and further propel market growth. Wood plastic composites are environment-friendly according to the U.S. Environmental Protection Agency (EPA). Hence, they can be used in infrastructure, residential, and commercial sectors owing to the recyclability and low greenhouse emission.

Segmentation by Product

• Polyethylene

• Polyvinylchloride

• Polypropylene

• Others

Polyethylene-based WPC dominated the U.S. market owing to various benefits such as high resistance to decay and marine borer attack. Furthermore, low cost, high stiffness, biodegradability, and abundant availability of raw materials are likely to open new avenues for market growth. Polyvinylchloride is expected to be the fastest growing segment over the forecast period, owing to high demand from automotive industry for manufacturing door panels, seat cushions, cabin linings, backrests, and dashboards.

Segmentation by Application

• Building & Construction

• Automotive

• Industrial & Consumer Goods

• Others

Builidng and construction was the dominant application segment in the past and is expected to expand at a significant CAGR over the forecast period. Increasing infrastructural development coupled with easy availability of raw materials are anticipated to drive growth in near future. Construction segment uses wood plastic composites for fencing, decking, and siding. High demand from this segment is anticipated to propel overall market. Automotive sector is projected to expand at the fastest CAGR over the forecast period, owing to its favorable properties such as light weight, machinability, durability, and eco-friendliness. Automakers are focusing on making biodegradable and recyclable automotive parts. This is expected to create new business avenues over the next eight years.

Segmentation by End Use

• Decking

• Molding & Siding

• Fencing

Consumers demand products with high aesthetic appeal and durability. Utilization of capstock-coated decking restricts mold formation and premature degradation. This factor is expected to augment market expansion over the forecast period. The decking application segment is expected witness a significant CAGR in near future owing to dimensional stability, low maintenance cost, and extended life span offered by WPC. Rising household renovation projects in U.S. are expected to promote molding and siding activities, which in turn, is likely to propel WPC market. Increasing consumer spending on exterior building products for high moisture resistance and protection from extreme environmental conditions is expected to augment demand in the forthcoming years.

Competitive Landscape

The U.S. wood plastic composite market players include Advanced Environmental Recycling Technologies, Inc.; Axion International, Inc.; CertainTeed Corporation; and Fiberon, LLC. The market is moderately consolidated, with presence of numerous manufacturers, leading to entry barrier for new entrants. Large companies such as Cairn International and Entec have established raw material extraction and purification units to produce Polypropylene (PP), Polyethylene (PE), Polyvinylchloride (PVC) and other products. This strategy supports in maintaining low cost, high quality, and high latency during manufacturing. Leading manufacturers are focusing on R&D to promote use of advanced polymers for improved durability.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service