Vegan Yogurt Market Size and Forecast, By Product (Soy, Almond, Rice), By Distribution Channel (Convenience store, Specialty store, E-retailer, Hypermarket/Supermarket), By Region, and Trend Analysis, 2019 - 2025

- Published: February, 2019

- Format: Electronic (PDF)

- Number of pages: 65

- Industry: Food & Beverages

Industry Insights

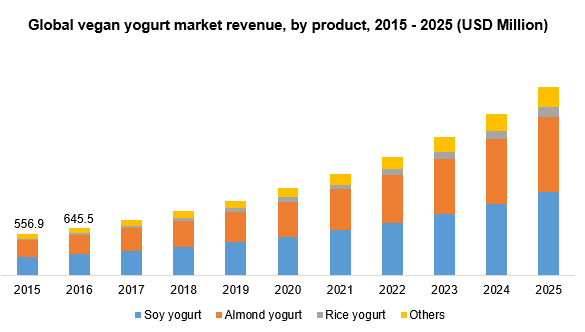

The global vegan yogurt market was valued at USD 748.8 million in 2017 and is anticipated to grow at a CAGR of 16.4% from 2017 to 2025. The increasing working population and their consciousness towards healthy eating habits are key factors driving the growth of the market. Furthermore, the shifting preference towards less fat and low sugar consumption and lactose-free products among adult population have paved the market for plant-based products including vegan yogurts.

Adoption of healthy lifestyle among all age groups has also added to the demand for vegan products. Consumers are seeking dairy-free products due to lactose intolerance and milk allergies. To this end, Brazil presents a considerable growth opportunity for vegan yogurt as according to a certain study, around 80.0% of the population in Brazil have lactose intolerance. Furthermore, the nutritional value of fat-free yogurt is increasing the consumption of vegan yogurts in developing economies.

The endorsement of vegan culture by famous celebrities and athletes has also spurred the demand in the market. Endorsement by renowned health institutions such as PBFC (Plant-Based Foods of Canada) and The Vegan Society has also helped in driving demand for these products including yogurt.

Various regulatory authorities are also promoting the consumption of vegan products. For instance, the Food and Drug Administration (FDA) of the U.S. has set up plans to introduce innovations in the production of vegan yogurt as well as other plant-based products. Similarly, the European Commission plans to set a legal definition of vegan food in 2019, which will be used as a benchmark for categorizing any product as the vegan. The commission aims to lay down proper guidelines for the companies indulging in the production of vegan foods and beverages and educate the consumers.

Segmentation by Product

• Soy

• Almond

• Rice

• Others

In 2017, almond yogurt accounted for around 40.0% of the market. Almond yogurt is one of the most preferred products in the market as it contains low cholesterol and unsaturated fats. Almond yogurt also helps in reducing the bad cholesterol as it contains polyunsaturated fatty acids.

Rice yogurt is the fastest growing segment in the market with a CAGR of more than 18.5% from 2017 to 2025. The rising lactose intolerance among consumers is paving the way for rice yogurts as these are an effective alternative to dairy milk with comparatively low calories and fat.

Segmentation by Distribution Channel

• Hypermarkets, supermarkets, and convenience stores

• Specialty store

• E-retailer

As of 2017, hypermarkets, supermarkets, and convenience stores segment was the largest distribution channel, accounting for more than 50.0% of the market. Number of these stores is remarkably higher than other format stores. These stores are preferred by consumers as they stock a wide array of daily use merchandise from various brands.

The e-retailer segment is expected to be the fastest growing distribution channel, growing at a CAGR of more than 17.0%. The increasing penetration of smartphones and the internet is supporting the growth of the online channel. The online channel provides convenience, a wide choice of products, and the ease of shopping while on the go.

Segmentation by Region

• North America

• Europe

• Asia Pacific

• Central & South America

• Middle East & Africa

North America accounted for more than 40.0% of the market revenue in 2017. Over the past few years, consumers are actively incorporating these foods into their diet. In the U.S. consumers are increasingly shifting towards vegan yogurt for enhanced nutritional value, positive health effects, and to promote environmental sustainability. In addition, the number of lactose intolerant people have increased over the past few years in the U.S., which is expected to promote the utility of alternative dairy products including vegan yogurt in the near future.

Asia Pacific is expected to growth at a CAGR of more than 16.0% from 2017 to 2025. High market visibility of soy yogurt product forms in countries such as Japan as a result of increased awareness towards gluten-free products is expected to remain a favorable factor in the coming years.

Competitive Landscape

The global vegan yogurt market is highly competitive where product innovation is expected to be a key trend. Companies are expected to innovate and launch new products in the coming years to strengthen their market positioning. In January 2019, Danone North America announced to launch Two Good Greek low-fat yogurt will come in different flavors including Vanilla, Strawberry, Peach, Mixed Berry, and Blueberry.

Companies are also taking initiatives to spread awareness among consumers about plant-based products. In February 2018, Danone entered into a partnership with Yakult Honsha Co, Ltd., a leading probiotic drinks company, to promote probiotics expand the Ishoku Dogen program aimed at spreading awareness about diet and health.

Some of the companies in the market include Danone, Hain Celestial, General Mills Inc., Daiya Foods Inc, Stonyfield Farm, Inc., Hudson River Foods, Inc., GOOD KARMA FOODS, INC., NANCY'S., Kite Hill, COYO Pty Ltd., and Chobani, LLC.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service