Visceral Pain Market Size and Forecast, By Therapeutics (Analgesics, Pain Modifiers), By Indications (Interstitial Cystitis, Crohn’s, Irritable Bowel, Chronic Prostatitis) And Trend Analysis, 2014 - 2024

- Published: May, 2017

- Format: Electronic (PDF)

- Number of pages: 75

- Industry: Clinical Diagnostics

Industry Insights

The global visceral pain market size was estimated at USD 9.51 billion in 2016 and is expected to witness substantial growth on account of its increasing prevalence. Moreover, growth in the interest of scientists and researchers in studying the pain originating from internal organs has mirrored in the consciousness of the importance of visceral pain in patients.

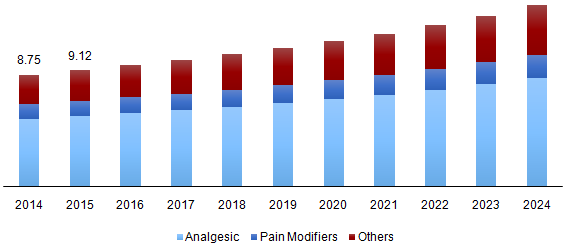

Global visceral pain market revenue, by therapeutics, 2014 – 2024 (USD Billion)

Over the past few years, various types of medications in the market are prescribed as off-label for the management of pain in spite of its analgesic properties. Due to this factor, novel targeted drug therapy will always be a growing market worldwide. The global geriatric population is anticipated to cross 2 billion by 2050, and this will act as a key factor for the expansion of the market worldwide.

High therapy costs are likely to hinder the growth of the market. However, the costs are expected to reduce owing to various factors including production scales, intensive research & development of these drugs and government grants & subsidies. Lack of awareness in the society has been a challenge for the growth of the market over the past few years.

In October 2015, Allergan acquired rights to Ironwood’s Constella (linaclotide) brand in Turkey, Switzerland, and the European Union. Furthermore, in October 2015, the company also reacquired the rights of LIZINESS in Mexico to expand their market and provide innovative therapies for the patients. In May 2017, Allergan Inc. announced the approval of VIBERZI by Health Canada which has helped the patients to overcome IBS.

Segmentation by therapeutics

• Analgesics

• Narcotics

• NSAID

• Pain modifiers

• Tricyclic Antidepressants

• Tricyclic Anticonvulsant

• Others

Analgesics accounted for the largest revenue share of 60.4% in 2016 as they are being used as the most common class of drugs used for the treatment of visceral pain. Analgesics are used as the first line of therapy, however, post a period their effect diminishes and can cause ceiling effect at any given dosage. Morphine and codeine are the drugs used in this category which has high chances of abuse, limiting the usage.

Pain modifiers market was valued at USD 1,257.5 million in 2016 and is expected to witness growth over the projected period. These include various products such as antidepressants that increase the level of certain brain chemicals including serotonin and dopamine which help improve mood and regulate pain signals.

These medications are frequently used in lower doses to treat chronic soreness. Antidepressants are usually reserved for chronic pain, as they may help relieve sleeping problems and fatigue caused by chronic soreness.

Segmentation by indications

• Interstitial cystitis

• Crohn’s

• Irritable bowel

• Chronic prostatitis

Crohn’s disease is the major cause of visceral pain contributing a total of 41.4% in 2016. People within the age group of 19-40 years are highly susceptible to this illness. The market is expected to rise due to an increasing prevalence of Crohn’s disease in upcoming years.

Irritable bowel is likely to be the fastest growing segment, with a CAGR of 7.9% from 2017 to 2024. Changing eating habits and lifestyle has resulted in increasing the occurrence of this disorder, which in turn is expected to drive the demand for therapies managing the disease. Availability of limited treatment options has resulted in attracting several companies to undertake R&D related to visceral pain.

Interstitial cystitis is the condition in which limited research and development are undertaken on account of its undetermined pathophysiological mechanism and etiology. Africa is likely to be a highly lucrative market for interstitial cystitis owing to the presence of a large patient pool.

Segmentation by region

• North America

• Europe

• Asia Pacific

• Rest of the world (RoW)

Although North America has been leading the market for visceral pain, it is expected that African countries will witness exponential growth during the forecast period due to a rising number of patients in the region. In September 2013, the Interleukin 12 & 23 was approved in the U.S. and was expected to open new avenues for growth over the forecast period. Brazil is expected to be a lucrative market owing to a large number of patients acting as a market for manufacturers.

Asia Pacific is expected to grow at the highest CAGR of 6.2% from 2017 to 2024. Crohn’s disease is observed to be the most common indication of visceral pain in the region. Crohn’s disease is expected to contribute 36.5% by 2024 owing to the availability of treatment drugs.

Competitive landscape

The global market is consolidated in nature with the presence of a limited number of manufacturers primarily concentrated in North America and Europe. Chinese as well as Indian market is expected to play important role in driving growth in long term due to strong uptake of remicade over the period. Companies such as Pfizer Inc., Allergan Inc., Johnson & Johnson services Inc. are some of the key players focusing on R&D and product innovation to increase their presence in the global industry.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service