Water Desalination Market Size and Forecast, By Technology (Reverse Osmosis, Multi-Stage Filtration, Multi-Effect Distillation), By Source (Seawater, Brackish Water, Wastewater), And Trend Analysis, 2014 - 2025

- Published: August, 2017

- Format: Electronic (PDF)

- Number of pages: 60

- Industry: Water & Sludge Treatment

Industry Insights

The global water desalination market was valued at USD 13.31 billion in 2016 and is expected to register robust growth owing to rise in demand for clean water, increasing population and disposable income of the people in the developing economies. Growing demand for a clean source for direct consumption as well as numerous industrial applications is expected to drive the demand for filtration technologies over the next few years.

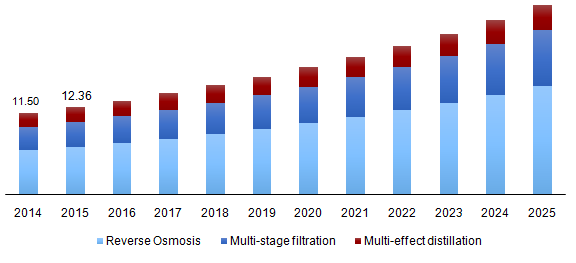

Global water desalination market revenue, by technology, 2014 - 2024 (USD Billion)

Technologies such as Reverse Osmosis (RO) and other membrane-based filtration techniques are expected gain share within the global market on account of their ability to consume less energy and provide superior purification. Countries such as Saudi Arabia and Algeria face a lack of energy supplies and water scarcity which is expected to result in new upcoming projects in the regions over the next few years.

These new projects are expected to adopt thermal technologies, including multiple effect distillation (MED), as they consume less energy than multiple-stage filtration (MSF). Furthermore, it is expected that Reverse Osmosis (RO) will be used in the upcoming projects owing to its lower energy consumption and cost effectiveness.

Organisations are undertaking various initiatives to provide services regarding desalination. For instance, in December 2016, Poseidon Water commenced operations at The Claude "Bud" Lewis Carlsbad Desalination Plant to provide the resource to the San Diego region minimising its dependence on other states.

Segmentation by Technology

• Reverse Osmosis (RO)

• Multi-Stage Filtration (MSF)

• Multi-Effect Distillation (MED)

The desalination market is expected to grow due to the rising demand for potable water, rapid industrialisation and rising population in the developing economies. Reverse Osmosis (RO) is expected to continue dominating the global desalination market owing to its cost effectiveness and increasing adoption in emerging economies such as China and India.

The increase in the treatment activities and the rising investments in the industries in the advancement of technology is expected to drive the desalination market. Predominantly, multi-effect distillation (MED) was extensively used, which has been replaced with MSF and RO over the past few years.

Segmentation by Source

• Seawater

• Brackish Water

• Wastewater

Desalination was widely used for purification of seawater making it the largest segment of the global industry. It is extensively used in numerous industrial processes as well as for domestic consumption.

Brackish water is anticipated to witness above-average growth at an 8.4% CAGR over the projected period. Increasing amount of brackish water being extracted for usage is expected to drive its growth over the next few years.

Segmentation by Region

• North America

• U.S.

• Europe

• Asia Pacific

• China

• India

• Central & South America

• Middle East & Africa

• Saudi Arabia

• UAE

Middle East & Africa dominated the global desalination industry in 2016 owing to scarcity in the regions. Additionally, rising population, rapid industrialisation, and depletion resources of freshwater resources have resulted in creating scarcity across these regions. Increasing utilisation of water across various industries including oil & gas, construction and manufacturing is expected to augment the market for desalination to cover the growing supply-demand gap.

North America is anticipated to witness the lucrative growth at a CAGR of 8.6% on account of heavy R&D investments by companies in the region. In 2016, approximately 300 gallons of water were consumed by an average American family per day. Growing need for potable source due to rising population is expected to drive the market in the region.

Competitive Landscape

The global market is fragmented in nature with the presence of a large number of desalination plants primarily concentrated in the Middle East & North America. The market comprises several key players such as GE Corporation, Doosan Heavy Industries & Construction, Suez Environnement, and Veolia Environnement S.A. Companies are focusing on R&D to improve their filtration technique at optimum cost.

Companies are focusing on joint ventures to provide sustainable desalination solutions. For instance, in June 2014, Veolia and John Holland entered in a joint venture to design, build and operate Sydney’s desalination plant on behalf of Sydney Water.

Choose License Type

- World's largest premium report database

- Transparent pre & post sale customer engagement model

- Unparalleled flexibility in terms of rendering services

- Safe & secure web experience

- 24*5 Research support service